All About Leasehold Improvements Depreciation Life

- Greg Pacioli

- Aug 19, 2025

- 4 min read

Updated: Nov 12, 2025

Leasehold improvements represent a significant investment for businesses that are leasing commercial spaces. It's essential to grasp their depreciation life for effective tax planning and to make the most of your deductions. This guide explains what leasehold improvements are, how their depreciation life is determined, and why proper classification matters for your business.

TLDR

Leasehold improvements depreciation life varies by type and IRS classification.

Qualified leasehold improvements (QLIP) generally depreciate over 15 years and may qualify for bonus depreciation.

Structural or integral components often require 39-year depreciation.

Accurate classification and documentation are critical for staying IRS compliant.

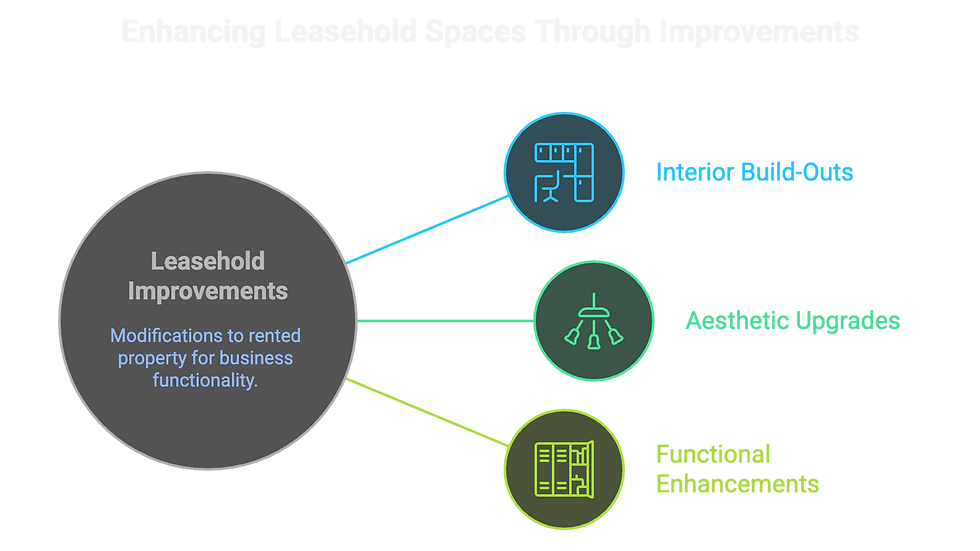

What Are Leasehold Improvements?

Leasehold improvements (LHIs) are modifications made to a rented property by a tenant to make it functional or aesthetically suited for their business. These can include:

Interior build-outs, like offices or retail counters

Upgraded lighting, flooring, or ceilings

Partition walls, cabinetry, or plumbing improvements

Importantly, while the tenant pays for these improvements, they often become part of the property. Properly accounting for them can impact tax deductions significantly.

Leasehold Improvements Depreciation Life

The depreciation life of leasehold improvements depends on IRS rules and the type of improvement:

Qualified Leasehold Improvement Property (QLIP):

Improvements to the interior of nonresidential buildings can generally be depreciated over 15 years under MACRS.

Many QLIP assets are eligible for 100% bonus depreciation, allowing full deduction in the first year.

Structural Components:

Improvements that are integral to the building, such as load-bearing walls or plumbing infrastructure, may require 39-year straight-line depreciation, the same as the building itself.

Personal Property vs. Real Property:

Fixtures, furniture, and equipment may have shorter depreciation lives (5–7 years) and should be classified separately from leasehold improvements.

🚩Red Flag: Misclassifying leasehold improvements can really mess with your deductions or even catch the IRS's attention. It's super important to keep thorough records, like invoices, contracts, and photos.

Why Leasehold Improvements Depreciation Life Matters

Tax Deductions

Accelerated depreciation or bonus depreciation can reduce taxable income in the first year, freeing up cash flow for reinvestment.

Accurate Accounting

Properly depreciating leasehold improvements ensures your financial statements reflect the true value of your assets over time.

Audit Preparedness

Clear classification and documentation protect your business if the IRS questions depreciation schedules.

QIP vs. Leasehold Improvements

While Qualified Improvement Property and Leasehold Improvements overlap, the distinction lies in purpose and tax treatment:

QIP: Focuses on property-wide enhancements that increase value, efficiency, or compliance with modern standards.

Leasehold Improvements: Typically tenant-specific, made to make leased space functional for a particular business.

Correctly identifying improvements ensures businesses take advantage of accelerated depreciation, bonus deductions, and potential tax credits.

Frequent Property Improvement Questions

Is HVAC qualified improvement property?

It depends. HVAC systems are generally not considered qualified improvement property (QIP) if they are part of the building’s structural system. QIP focuses on interior improvements that enhance functionality or usability of leased commercial space. However, certain standalone or tenant-installed HVAC components may qualify if they are not integral to the building structure. Proper classification is essential to ensure compliance and maximize depreciation benefits.

Are land improvements eligible for bonus depreciation?

Generally, land improvements are not eligible for any depreciation. Bonus depreciation applies to tangible property with a determinable useful life, but land itself is not depreciable. Certain land improvements (like parking lots, sidewalks, landscaping, or fencing) may be eligible if they are considered separate depreciable assets under IRS rules, often with a 15-year life. Correct classification is critical to ensure proper tax treatment and to take advantage of accelerated depreciation when applicable.

Is a roof qualified improvement property?

No. A roof is not classified as qualified improvement property (QIP) under current IRS guidelines. QIP specifically covers interior improvements to nonresidential buildings, whereas a roof is considered a structural element of the building. Roof costs may be depreciated over the building’s 39-year life or, in some cases, qualify for other depreciation rules if it meets energy-efficient improvement criteria.

Can you take section 179 on qualified improvement property?

Yes, in many cases, qualified improvement property (QIP) can be eligible for Section 179 expensing. Section 179 allows businesses to immediately deduct the cost of qualifying property rather than depreciating it over several years. However, eligibility depends on the type of improvement and whether it is placed in service during the tax year. Interior improvements that enhance nonresidential property often qualify, but structural components like elevators or escalators typically do not. Always consult a qualified tax advisor to confirm eligibility for Section 179 expensing on QIP.

A Note to CRE Investors

Grasping the depreciation life of leasehold improvements can have a significant effect on your profits. It’s all about positioning your investments to cut down on taxes, boost cash flow, and get the most out of every property in your portfolio. By pinpointing which improvements are eligible for accelerated or bonus depreciation, you can really capitalize on the tax benefits available in the year they’re put into service.

Navigating these regulations can be a bit tricky, which is why teaming up with a knowledgeable tax advisor is crucial. On the FindCostSeg Directory, you can connect with certified experts who focus on cost segregation and leasehold improvements, making sure your investments are set up for optimal financial efficiency and long-term success.

Comments